The Basic Principles Of Hard Money Atlanta

Table of ContentsGet This Report about Hard Money Atlanta6 Simple Techniques For Hard Money AtlantaHard Money Atlanta Things To Know Before You Get ThisHard Money Atlanta - Questions

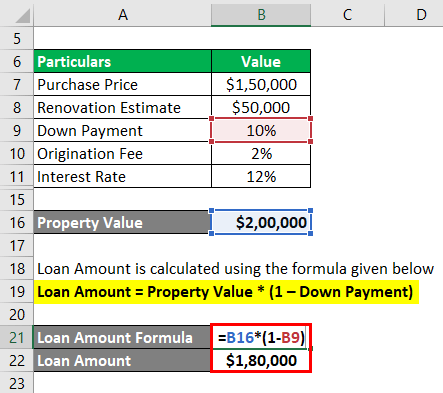

Because hard money loans are collateral based, likewise referred to as asset-based lendings, they call for very little documents as well as permit investors to enclose a matter of days. However, these lendings come with even more threat to the lending institution, as well as as a result require higher down payments and also have greater interest rates than a traditional lending.Many conventional financings might take one to two months to shut, yet tough cash financings can be closed in a few days.

Typical home mortgages, in comparison, have 15 or 30-year repayment terms on standard. Hard cash loans have high-interest rates. A lot of hard cash financing rate of interest prices are anywhere in between 9% to 15%, which is dramatically higher than the passion price you can expect for a conventional home mortgage.

When the term sheet is authorized, the financing will certainly be sent to processing. During funding handling, the loan provider will ask for files as well as prepare the loan for last loan review and also routine the closing.

Getting My Hard Money Atlanta To Work

You'll need some funding upfront to certify for a hard money financing and the physical home to offer as collateral. In enhancement, tough cash loans usually have greater interest prices than typical mortgages. hard money atlanta.

Usual leave strategies consist of: Refinancing Sale of the asset Payment from various other resource There are several circumstances where it may be beneficial to use a difficult cash financing. For starters, actual estate capitalists who such as to house turn that is, purchase a review residence in demand of a whole lot of job, do the job personally or with professionals More Bonuses to make it extra valuable, after that turn about as well as market it for a greater price than they bought for may discover difficult money lendings to be optimal financing options.

Because of this, they don't require a lengthy term as well as can avoid paying too much rate of interest. If you purchase financial investment residential or commercial properties, such as rental residential or commercial properties, you may also find difficult money finances to be excellent choices.

The Main Principles Of Hard Money Atlanta

In some situations, you can likewise use a difficult money car loan to buy vacant land. Keep in mind that, also in the above situations, the possible drawbacks of tough money financings still use.

While these types of loans might appear challenging and also challenging, they are a generally made use of financing method many genuine estate capitalists utilize. What are hard money fundings, and just how do they function?

Difficult money lendings generally feature greater passion rates as well as much shorter settlement routines. Why pick a difficult cash car loan over a conventional one? To respond to that, we ought to initially take into consideration the benefits and negative aspects of hard cash lendings. Like every financial tool, difficult cash loans featured benefits and drawbacks.

Rumored Buzz on Hard Money Atlanta

Additionally, due to the fact that private individuals or non-institutional lenders provide tough money finances, they are exempt to the exact same regulations as traditional lending institutions, that make them more dangerous for consumers. Whether a difficult money finance is ideal for my link you relies on your scenario. Difficult cash car loans are great alternatives if you were denied a traditional finance and also require non-traditional funding.

Get in touch with the experienced home loan consultants at Right Beginning Mortgage for more info. Whether you intend to acquire or re-finance your house, we're below to assist. Start today! Ask for a complimentary tailored price quote.

The application process will normally include an evaluation of the building's worth as well as possibility. That means, if you can't manage your repayments, the tough cash loan provider will just relocate in advance with selling the property to recover its investment. Difficult money lending institutions typically charge like it greater rate of interest prices than you would certainly carry a traditional loan, yet they additionally money their fundings quicker as well as generally call for less documents.

Rather of having 15 to thirty years to pay off the lending, you'll generally have just one to five years. Tough money financings work rather differently than typical fundings so it is essential to recognize their terms as well as what transactions they can be made use of for. Difficult money lendings are usually meant for financial investment residential properties.

Comments on “The Hard Money Atlanta Ideas”